All Categories

Featured

Table of Contents

There is no payout if the policy expires before your fatality or you live past the policy term. You may be able to renew a term plan at expiration, however the costs will certainly be recalculated based on your age at the time of revival.

At age 50, the premium would increase to $67 a month. Term Life Insurance Policy Fees 30 years old $18 $15 40 years of ages $28 $23 50 years old $67 $51 Resource: Quotacy. Quotes are for a $250,000 30-year term life policy, for guys and ladies in outstanding wellness. On the other hand, here's a take a look at rates for a $100,000 entire life policy (which is a kind of long-term policy, meaning it lasts your lifetime and includes cash value).

Interest prices, the financials of the insurance policy company, and state policies can additionally impact costs. When you take into consideration the amount of coverage you can obtain for your premium bucks, term life insurance policy has a tendency to be the least expensive life insurance coverage.

He acquires a 10-year, $500,000 term life insurance coverage plan with a costs of $50 per month. If George dies within the 10-year term, the policy will pay George's recipient $500,000.

If George is identified with a terminal health problem throughout the first plan term, he probably will not be qualified to renew the policy when it ends. Some plans provide guaranteed re-insurability (without proof of insurability), yet such features come with a higher expense. There are numerous sorts of term life insurance policy.

Many term life insurance has a level costs, and it's the type we've been referring to in many of this short article.

Long-Term Group Term Life Insurance Tax

Term life insurance policy is eye-catching to youths with children. Parents can acquire significant protection for an inexpensive, and if the insured passes away while the policy holds, the family members can rely upon the survivor benefit to change lost earnings. These plans are likewise appropriate for individuals with growing families.

Term life plans are excellent for individuals who want considerable protection at a reduced price. People that own entire life insurance policy pay more in premiums for much less protection but have the protection of understanding they are shielded for life.

The conversion biker must permit you to transform to any kind of long-term policy the insurer offers without constraints. The key features of the rider are preserving the initial health score of the term policy upon conversion (also if you later have health and wellness concerns or become uninsurable) and deciding when and how much of the insurance coverage to transform.

Of program, total premiums will certainly enhance significantly considering that whole life insurance policy is more costly than term life insurance. The benefit is the guaranteed approval without a clinical test. Clinical problems that develop during the term life duration can not trigger premiums to be enhanced. However, the business may require limited or complete underwriting if you intend to include extra bikers to the brand-new plan, such as a long-term treatment cyclist.

Term life insurance policy is a reasonably cost-effective way to supply a round figure to your dependents if something happens to you. It can be a great choice if you are young and healthy and balanced and sustain a household. Whole life insurance policy features significantly greater monthly costs. It is indicated to offer coverage for as lengthy as you live.

Leading Short Term Life Insurance

It depends on their age. Insurance coverage business set an optimum age limitation for term life insurance policy plans. This is generally 80 to 90 years of ages but might be higher or lower depending on the company. The premium likewise climbs with age, so a person aged 60 or 70 will certainly pay considerably more than a person decades more youthful.

Term life is rather comparable to car insurance coverage. It's statistically unlikely that you'll need it, and the premiums are money away if you don't. If the worst takes place, your family will receive the benefits.

The most popular type is currently 20-year term. Many firms will not offer term insurance to an applicant for a term that finishes past his/her 80th birthday. If a plan is "sustainable," that suggests it continues effective for an extra term or terms, up to a defined age, even if the health and wellness of the guaranteed (or other aspects) would certainly create him or her to be denied if she or he looked for a new life insurance policy plan.

So, premiums for 5-year sustainable term can be level for 5 years, then to a brand-new rate mirroring the new age of the guaranteed, and so on every 5 years. Some longer term policies will guarantee that the costs will certainly not increase throughout the term; others don't make that assurance, enabling the insurer to increase the price during the policy's term.

This indicates that the policy's owner deserves to transform it right into an irreversible kind of life insurance without additional evidence of insurability. In a lot of kinds of term insurance, including property owners and vehicle insurance coverage, if you haven't had a claim under the policy by the time it expires, you obtain no reimbursement of the premium.

Quality Annual Renewable Term Life Insurance

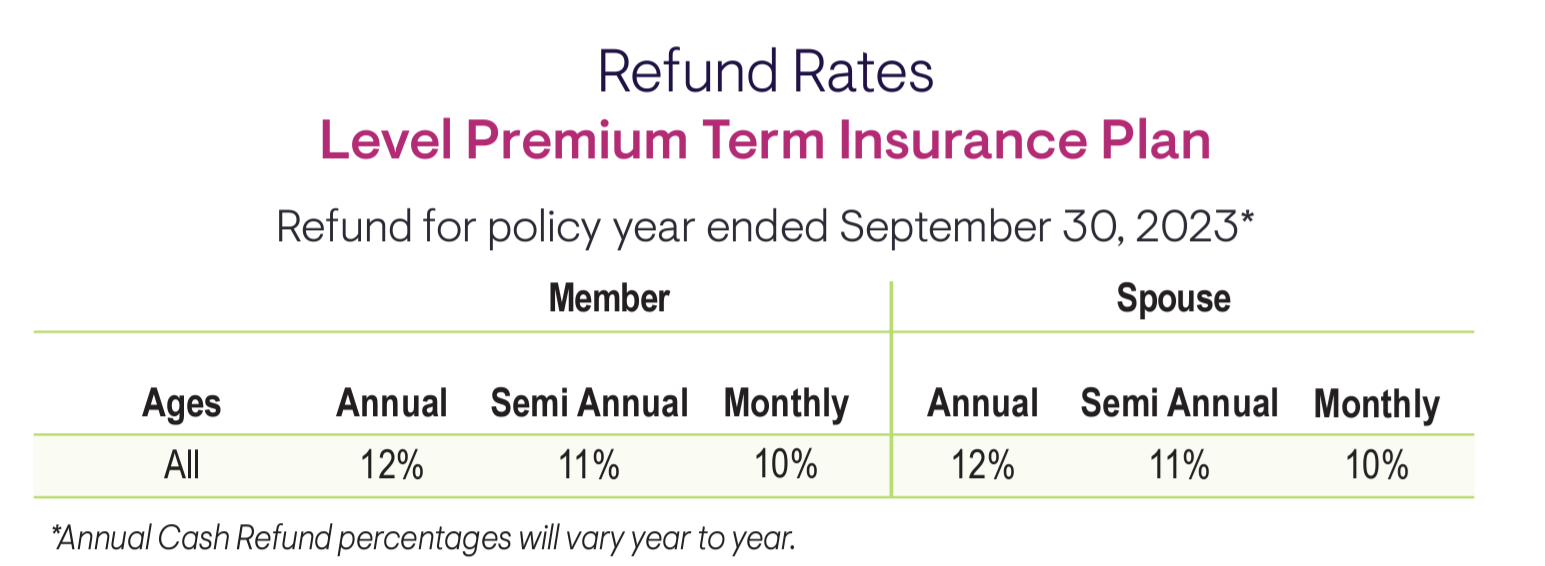

Some term life insurance policy customers have been miserable at this result, so some insurance companies have actually created term life with a "return of costs" attribute. what is direct term life insurance. The costs for the insurance policy with this attribute are typically considerably higher than for plans without it, and they normally need that you maintain the plan active to its term otherwise you waive the return of costs benefit

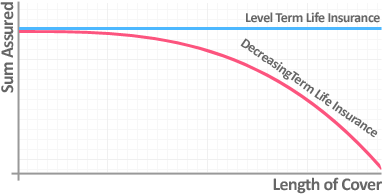

Degree term life insurance coverage costs and fatality benefits continue to be constant throughout the policy term. Degree term life insurance coverage is generally extra budget-friendly as it does not construct money value.

Top A Term Life Insurance Policy Matures

While the names often are used reciprocally, degree term coverage has some essential distinctions: the costs and fatality advantage remain the same throughout of insurance coverage. Level term is a life insurance policy where the life insurance policy premium and survivor benefit stay the exact same throughout of insurance coverage.

Latest Posts

Funeral Insurance Regulation

Aarp Burial Insurance Seniors

Funeral Assurance